How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

,Privacy is the power to selectively reveal oneself to the world.

— Eric Hughes, The Cypherpunk Manifesto

Unchained Capital offers collaborative custody: a superior approach to security that combines the control of self-custody with the benefits of a managed financial service. Collaborative custody allows users to control private keys and to create redundancy by distributing keys among known and trusted participants.

At Unchained Capital, we value Bitcoiners who choose to remain anonymous, and we recognize that privacy and anonymity are distinct, requiring different approaches. Consistent with these values, we developed tools for all users to leverage enhanced multisignature security, including those that prioritize anonymity.

Read on to understand how we deliver open source tools for anonymous users and premium products for the privacy-conscious users that value having a trusted financial partner.

We recommend that those wishing to maintain the highest levels of anonymity in bitcoin take the following steps to avoid leaking personal information:

Additionally, you should only use 100% open source tools on your own computing devices. There are many choices for open source nodes, wallets, and other tools. The Bitcoin ecosystem embraces the open source ethos, so it’s certainly possible for a motivated (if technically proficient) HODLer.

If using 3rd party services is unavoidable, it’s important to be aware of risks and ways to mitigate them.

For example, Bitcoin records transactions on the blockchain for all time. Whenever you transact, you generate correlated data in off-chain systems. Most of this data will survive forever in some form and could be analyzed in the future with improved tools and with greater context than we have today.

If you bought your bitcoin on a centralized exchange, such as Coinbase, then you’re already de-anonymized, at least to Coinbase. If you at any time decide to use a regulatory-compliant exchange, desk, or financial service in the future, you may run the risk of de-anonymizing your present behavior.

The ecosystem is developing and deploying tools such as TOR, Samourai Wallet, Wasabi Wallet, and JoinMarket to increase user anonymity, but such projects are in an arms race with companies such as Chainalysis and the desires and reach of regulators. It’s difficult to run fast enough to avoid being de-anonymized by your usage.

You may feel that no one knows you have bitcoin, but every interaction you have with your keys makes your association slightly more known to the rest of the world. This is especially true of interactions with companies. Very few of us are as anonymous as we suppose. (Satoshi manages it by HODLing forever.)

Unchained Capital publishes open source tools to deliver a better interface for multisig cold storage without having to reveal personal information to any company.

Users can use their cold-storage devices to manage multisig addresses independently, anonymously, and with whomever they decide to reveal themselves.

For privacy-conscious users that accept the tradeoff of selectively revealing personal information to a trusted financial partner like Unchained, we designed a premium experience with an excellent user interface, valuable financial services, and the enhanced security of a trusted cosigner.

When a client chooses Unchained, they are making a decision to reveal themselves selectively to our company, and not to anyone else, in exchange for better security, redundancy, support, and more value from their holdings. These are benefits of trusting Unchained with your privacy.

Ensuring that our clients’ information remains private is one of our most critical responsibilities as a company. We recognize that you’re entrusting us with your privacy and sacrificing anonymity. We believe the benefits you gain from collaborative custody and access to our financial services outweigh the risk of de-anonymizing yourself to Unchained.

Minimizing privacy risks for our clients is a top priority at Unchained. We collect the minimum information we need to satisfy regulatory requirements and to ensure the highest level of security. We do not monetize your personal data or use it in any way except as described below.

Information is not shared with 3rd-parties except for

You can read all the most current details of what we collect, when, and how we protect it here.

Good security relies on having multiple “things you have” as well as “things you know.” If you are using hardware wallets, good software, 2FA devices, etc., you are relying on both to protect your bitcoin.

Bitcoin owners can benefit from choosing dedicated, trusted multisig partners when they want to protect against the loss of some subset of their secrets or against their own death or incapacitation. Because they help you re-establish control over your funds if some subset of your keys are lost, it’s critical that these partners know how to verify your identity and intent.

This can be done using just “things you know” (such as passwords or the answer to security questions), but your physical, vocal, and legal identity are important dimensions of your personal security. Passwords and security questions are not a substitute for identity verification.

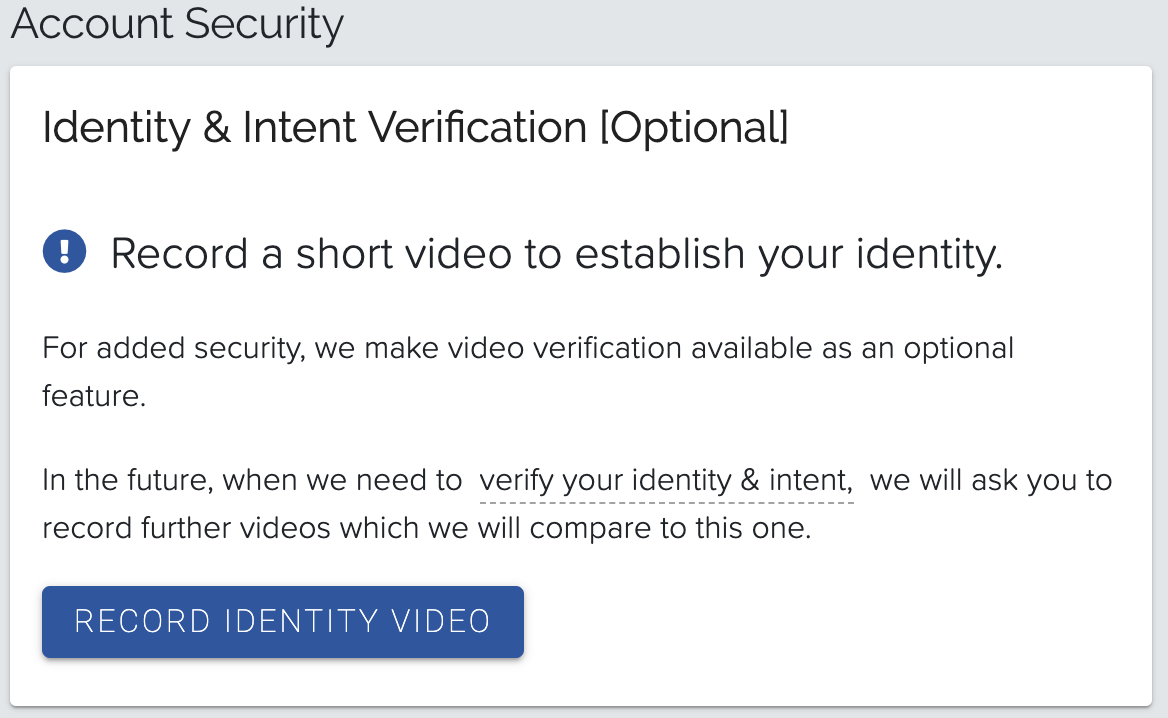

In addition to verification of government-issued identification, we also provide optional video verification as an incremental security feature to a client authenticating a transaction with their own private key.

Whether your multisig partner is a company or a close personal relationship, a recording of your physical identity and voice on video enables that person to verify your intent. This is only reliable if your partners know who you are!

Verifying the integrity of client-initiated transactions before we sign is our most critical priority as a company, which is why we rely on a variety of methods to identify our customers.

With a collaborative custody vault, Unchained holds 1-of-3 keys in your quorum (thing we have). In order to offer true security, we need to know your identity and your intent (things we should know).

Unchained Capital is a financial institution as defined by the Bank Secrecy Act (BSA). As a financial institution, we are required to follow Anti-Money Laundering (AML) and Know Your Customer (KYC) practices. To comply, we must collect and verify sufficient information to form a reasonable belief that we know the true identity of the customer.

We take a risk-adjusted approach to each of our products, ensuring that we collect the minimum information necessary as determined by our legal and regulatory advisors. We take a conservative approach to AML/KYC due to the highly regulated nature of financial services and the heightened level of scrutiny that cryptocurrency-related companies receive.

We believe that not performing even minimal AML/KYC is an aggressive regulatory position for any financial institution which offers to hold a key in a multisig quorum with another individual or company. Such a position could create greater long-term privacy risk for clients because it invites regulatory scrutiny.

A financial services company that is not regulatory compliant invites unwanted scrutiny, which creates risk.

Not all wallet providers or applications are financial institutions. As a result, they likely do not have the same regulatory requirements that we do, and they may not be subject to the same scrutiny.

As a financial institution, not performing any KYC/AML also increases the risk that we accidentally take on bad actors as customers, putting our honest customers at undue risk of greater scrutiny from regulators or law enforcement.

Our HODL waves analyses highlight the cycles that occur as bitcoin grows and wins new cohorts of investors. At Unchained Capital, we believe these cycles tell an important part of the story of both bitcoin and each individual HODLer. With each new wave, the value of bitcoin and our customers’ wealth grows, increasing the importance of greater long-term security.

Unchained Capital is not a technology layer or app. We are a trusted financial partner to our customers. We start by protecting our customers’ wealth, and we want to work with them through the full lifecycle of bitcoin adoption and its role within their financial lives. During each rally and winter, we want to provide our customers with the best security and the most useful services.

We will continue to deliver additional financial products and services over time, all of which will benefit from knowing our customers.

More meaningfully, having a relationship with each of our customers helps us provide the right services at the right time. Follow us for updates on future products that leverage collaborative custody to deliver safer financial services.

Should you have any questions, please email us at help@unchained.com.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis